- Lightspeed

- Posts

- ♠️ ACE of trades

♠️ ACE of trades

Is this the end of single leader dominance?

Howdy!

Welcome back to Lightspeed, aka your favorite newsletter’s favorite newsletter.

Today, we’ve got Solana’s internet capital markets roadmap, ETH gaining ground, and a potential REV drawback for Jito’s BAM:

IBRL, plus one more thing

For some time now, Solana's pitch has hinged on the levers of bandwidth and latency.

However, as we've seen from the limitations of high-frequency trading systems and the often uneven performance of existing onchain order books, high throughput and sub-second finality alone are likely insufficient to support the future of global markets.

While that may sound counterintuitive for a chain built on speed, it's now emerging as the core thesis of a new, community-authored roadmap that lays out how Solana can become the backbone for internet capital markets.

Released last week, this new roadmap was co-authored by Anatoly Yakovenko (Solana Labs), Max Resnick (Anza), Lucas Bruder (Jito Labs), Austin Federa (DoubleZero), Chris Heaney (Drift) and Kyle Samani (Multicoin Capital).

They argue that in addition to solving for bandwidth and latency, the network must also account for market microstructure.

Solana wants to be the best place to build — not just for liquidity and scale, but for custom markets themselves. To do that, it needs to let applications control the rules of their own transaction sequencing.

The roadmap proposes a shift toward application-controlled execution (ACE), a model that would give smart contracts granular control over how trades are ordered and settled.

ACE breaks with the single-leader norm in favor of programmable execution environments and multiple concurrent validators.

Combined with infrastructure upgrades like Jito's Block Assembly Marketplace (BAM), the DoubleZero fiber network and the upcoming Alpenglow consensus engine, Solana apps will soon be able to define bespoke order-matching rules designed to rival Wall Street systems.

BAM, rolling out in late July, enables apps to integrate custom sequencing logic — effectively delivering ACE today via a decentralized, TEE-powered network. It turns Solana blockspace into a programmable sandbox where developers can ship tailored order flow logic without forking clients or cutting BD deals with validators.

DoubleZero, currently live on testnet with over 100 validators and 3% of mainnet stake, reduces latency and jitter across the network by replacing the public internet with a multicast fiber backbone. It's expected to go live on mainnet in mid-September.

Alpenglow, currently slated for late 2025 or early 2026, finalizes blocks in ~150ms and simplifies Solana's consensus logic to support faster execution and future features, such as MCL and async program execution (APE).

By these powers combined — along with MCL, which introduces multiple simultaneous leaders — developers will be able to build high-performance markets without relying on good validator behavior or suffering from the single-leader bottleneck.

If successfully executed, the post’s authors believe that Solana apps will offer fairer, faster and more transparent trading, closer to a CEX experience but without compromising decentralization. Devs will unlock permissionless experimentation with tools like speed bumps, quote protection and order privacy. And for institutions, it will open the door to globally synchronized, composable liquidity onchain.

— Jeffrey Albus

P.S. Fill out our short audience survey and help us build a better Lightspeed. Thank you!

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto, and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 pm EST

Well I’ll be darned:

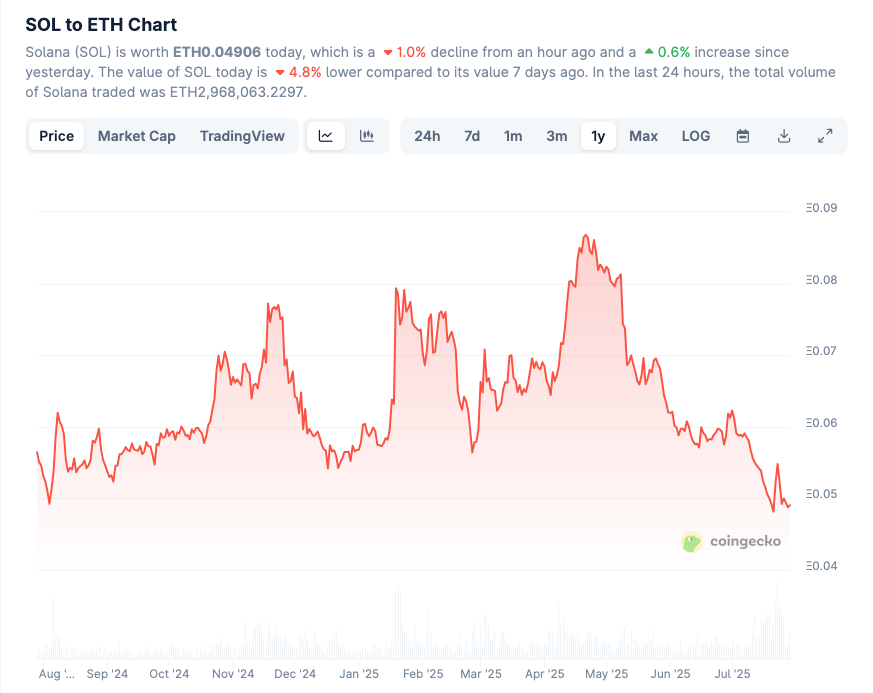

SOL:ETH, or the ratio of Solana’s price to Ethereum’s, dipped below 0.05 for the first time in a year.

Despite some of the criticisms of ETH on the value accrual side, the second-biggest crypto wiped out a year’s worth of gains from Solana over the course of a few months. Well played, Ethereum.

— Jack Kubinec

Jito rolled out its new transaction processing architecture last week to much fanfare. But could BAM give a slam to Solana’s REV — or tips and fees paid to transact on the blockchain?

In a research note on the forthcoming upgrade, Blockworks Research’s Carlos Gonzalez Campo noted that BAM’s pledge to help applications capture revenue could divert income away from Solana and the Jito Foundation.

“The majority of REV derives from trading activity, especially around contentious transactions and when the need for fast transaction inclusion is high. Assuming a significant proportion of MEV is internalized by applications via custom transaction sequencing, BAM could lead to a reduction in topline revenue for the Jito DAO and SOL token holders,” Gonzalez Campo wrote.

Still, BAM reducing fees per transaction could also have the effect of driving up aggregate demand for Solana’s blockspace, which would keep REV and yield for stakers and JTO holders elevated.

This is all just conjecture for now, as we won’t know what BAM’s impact will be until the new architecture is rolled out in the coming weeks.

— Jack Kubinec

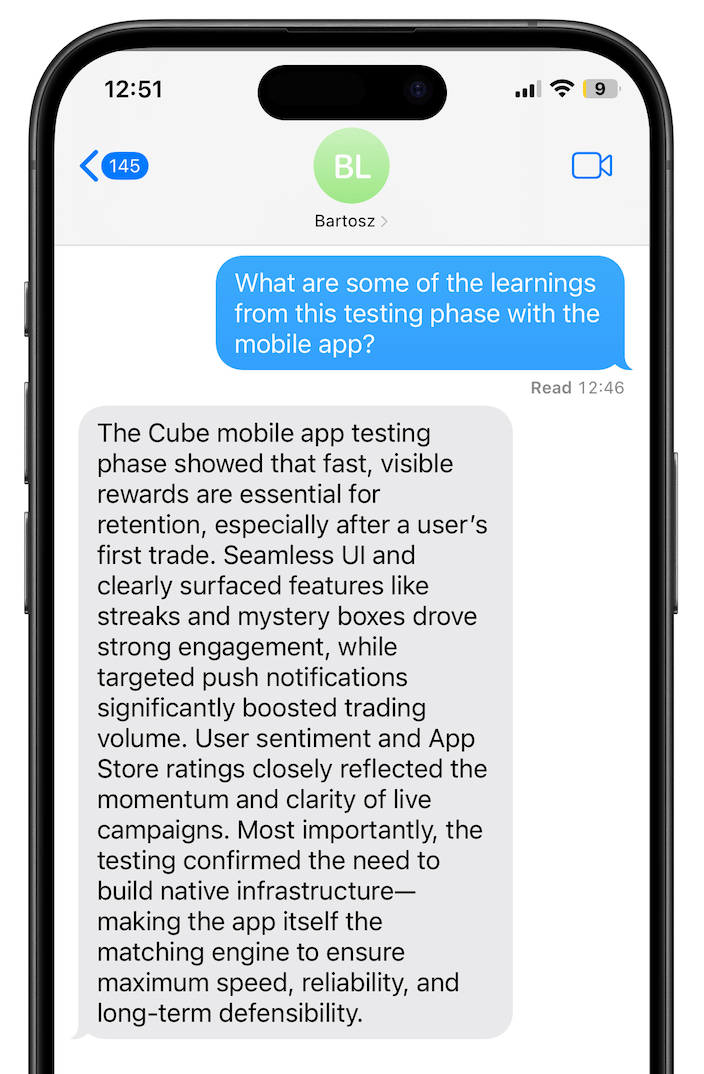

A message from Bartosz Lipinski, co-founder of Cube:

Spread Solana cheer to make perks appear 🎉

Don’t keep us a secret. Tell your friends and bag some bonuses with the Lightspeed referral program.

📣 3 referrals: A personal shoutout in the Lightspeed newsletter

💬 10 referrals: Lightspeed host and newsletter writer Jack will put you in the One Good DM section of one edition