- Lightspeed

- Posts

- 📨 Decentralized content delivery

📨 Decentralized content delivery

Pipe Network launches mainnet

hello

DePIN is kind of like the industry’s underappreciated stepchild: doing boring, unglamorous work with real-world utility.

We’ve got another one of those stories today. Let’s take a look at Pipe Network’s mainnet launch.

0xResearch returns to its analyst roots. Daily alpha and insights now coming directly from our research team. Investment research, market commentary, and unfiltered data-driven takes in your inbox.

Pipe Network launches mainnet and token

The decentralized content delivery network (CDN) Pipe launched on Solana mainnet today alongside the token generation event of its PIPE token.

Pipe is integrating Jito's Node Consensus Network (NCN) as its economic security layer, effectively restaking a pool of already staked SOL without standing up its own validator set. Pipe node operators will stake PIPE tokens to participate in the network.

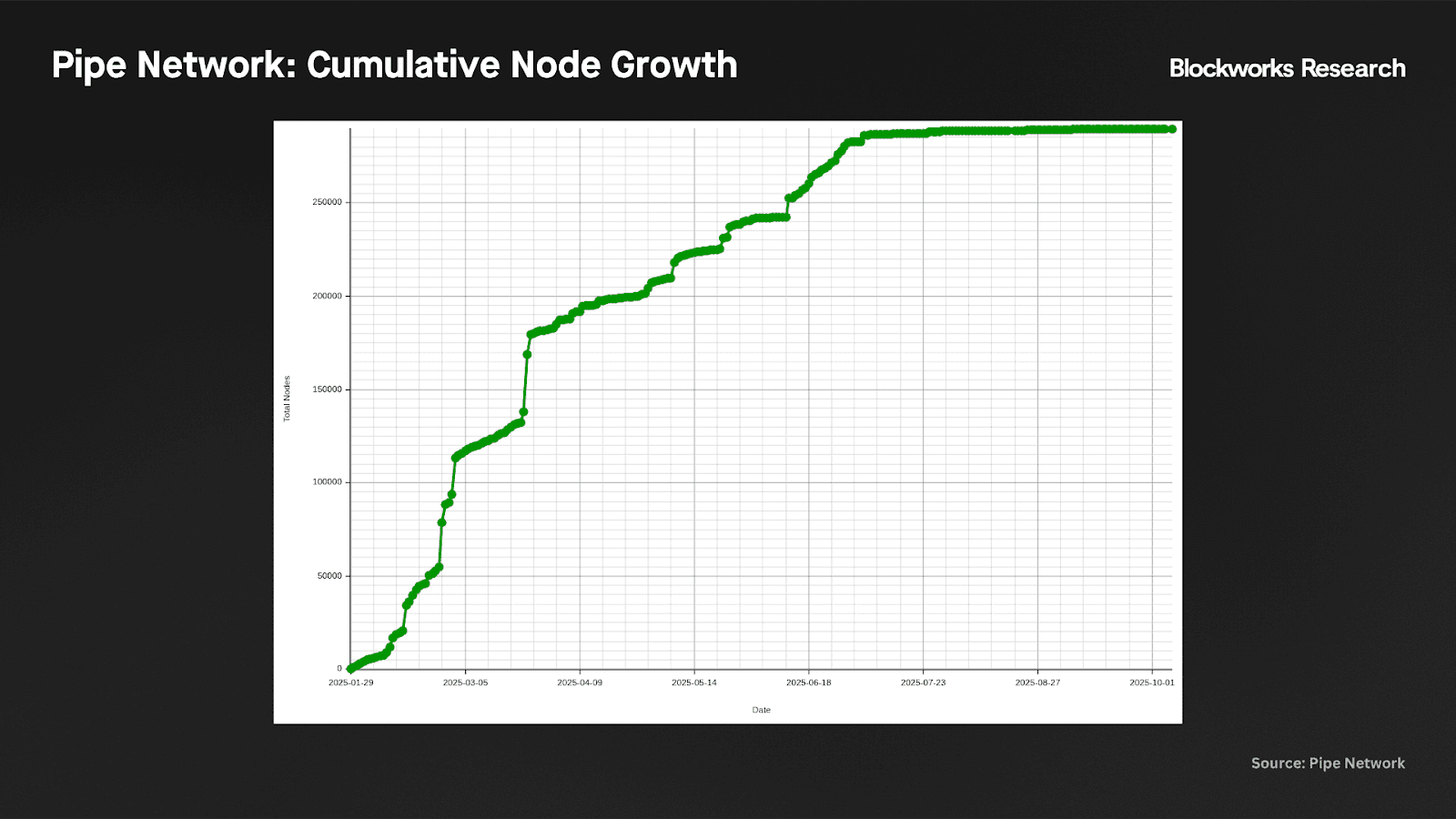

The testnet has delivered 60+ petabytes of data across a network of ~290,000 Point of Presence (PoP) nodes, reporting ~70% lower latency and ~100x cost efficiency than traditional CDNs, according to Pipe’s press release.

About $2.5 million in PIPE testnet tokens have been burned to date.

“Our CDN is ready to go live and compete against the offerings from Cloudflare, Fastly, Akamai and Web2 stalwarts of the world,” David Rhodus, founder of Permission Labs and core contributor to Pipe Network said, emphasizing Pipe’s performance and uptime “at the edge” as a traditional weak spot for incumbents.

CDNs act as local delivery hubs for the internet, caching popular content in local data centers near users so websites, videos and apps load faster.

Pipe aims to provide the same service using a DePIN (decentralized physical infrastructure) model. Instead of owning or leasing thousands of servers, it coordinates independent node operators’ under-utilized resources to expand capacity where bandwidth is scarce and costly.

This distributed supply model gives Pipe two key advantages. One, Pipe can scale and target regions where bandwidth costs have historically been prohibitive. Based on its roadmap, Pipe’s stated expansion efforts include regions like South Korea and emerging markets like India and Egypt.

Secondly, it enables Pipe to welcome and monetize AI-agent traffic that are often default-blocked by incumbent CDNs due to rising egress costs from AI crawlers, or intellectual property concerns around model training from CDN’s customers.

Pipe is estimated to be generating at least about $55 million in annualized revenues, with stated revenue targets of at least $100 million in ARR by end of 2025, according to a report by Blockworks Research’s Nick Carpinito.

Pipe Network usage

Pipe’s flagship CDN has been used to store saved states of the Solana network’s ledger and the chain’s full Proof-of-History archival dataset, amounting to about 1.5 petabytes stored with roughly 100 terabytes of daily egress.

The PIPE token can be used to pay for CDN usage and the company’s Firestarter Storage offering, which went live in late July.

Following mainnet, Pipe plans to introduce a liquid stake delegation program with Jito, directing staked PIPE to Pop nodes based on bandwidth and uptime.

There has been a Cambrian explosion of Digital Asset Treasury companies.

Don’t miss the chance to hear Lightspeed legend @smyyguy make sense of DAT data live at DAS London.

Get your ticket today with promo code: LIGHT100 for £100 off

📅October 13-15 | London

SOL DAT update:

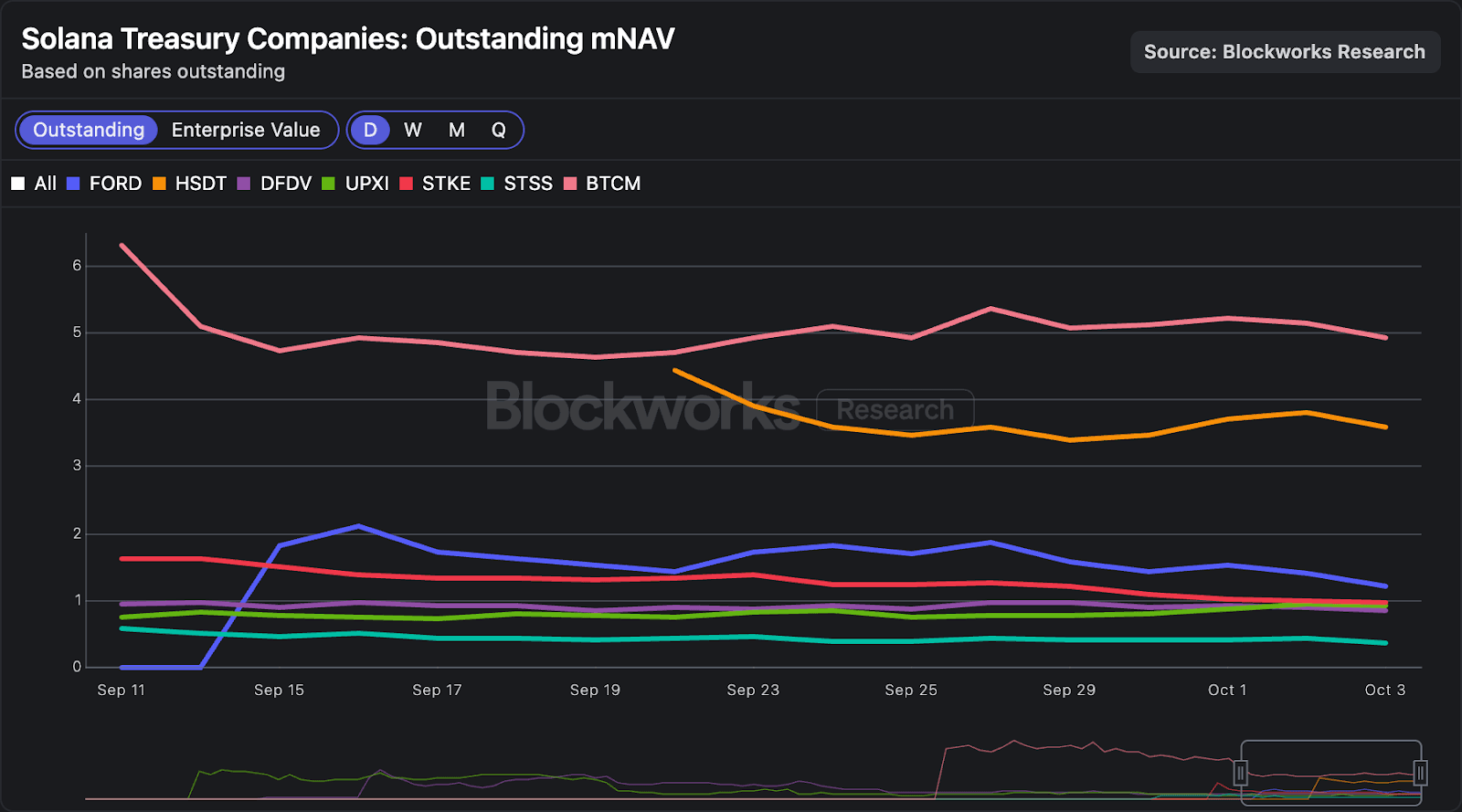

Forward Industries (FORD), Solana Company (HSDT) and Bit Mining (BTCM) remain the only three Solana DATs whose mNAVs continue to trade above 1.

As of today, all Solana DATs collectively hold a total of 14.1 million SOL ($3.2 billion), about 2.3% of the total SOL supply.