- Lightspeed

- Posts

- 📊 Friday Solana charts

📊 Friday Solana charts

JTO is bullish

Brought to you by:

hello

Today’s Lightspeed edition is a roundup of everything exciting going on in Solana this week.

Jack’s podcast with the Jupiter and Fluid team on their upcoming Jupiter Lend product launch is going to be out later next week, but we’ve summarized some key early insights for you below.

Solana weekly recap

Here’s a roundup of everything exciting happening in Solana this week.

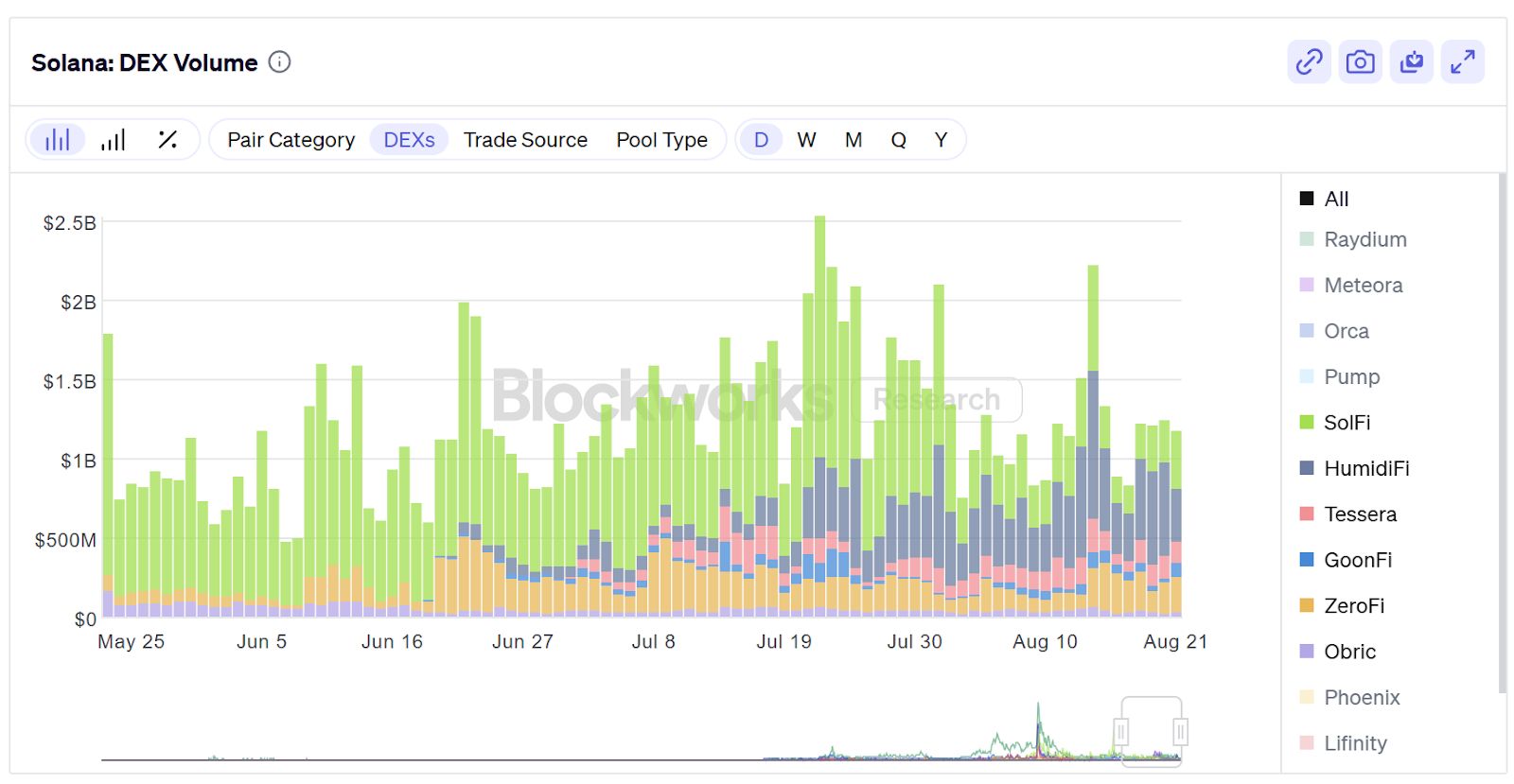

Solana AMMs with proprietary market markers, otherwise known as prop AMMs, showed strong traction with about $1.1 billion in daily DEX volumes in the last seven days.

Prop AMMs are probably the most interesting phenomenon changing Solana’s market structures in recent months. By keeping liquidity provision private, these new AMMs are able to protect against toxic MEV orderflow, thereby allowing for tighter spreads and execution for users on typically highly liquid asset pairs. You can read all about them in Lightspeed coverage from earlier this week.

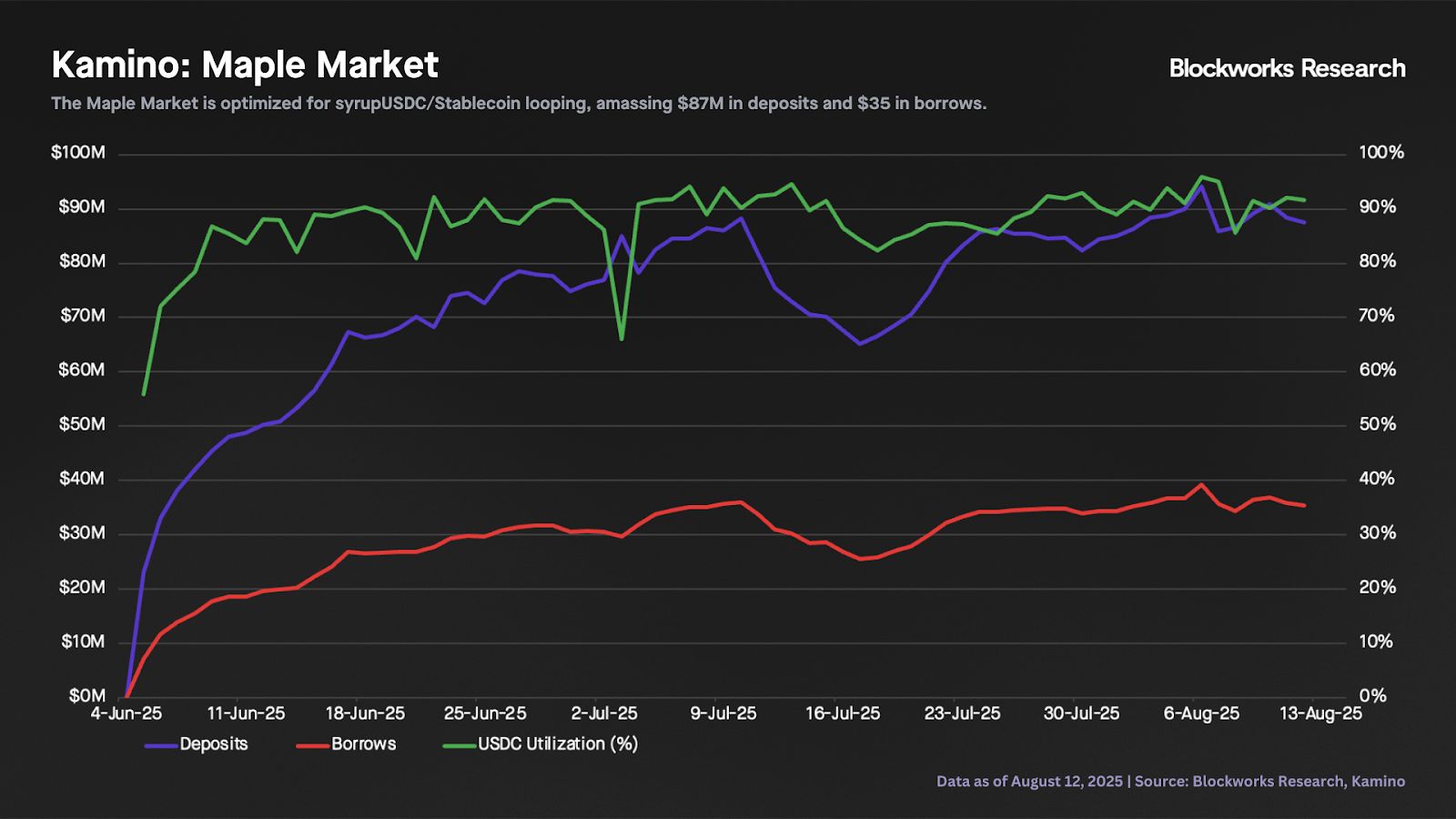

The Maple market on Kamino has rapidly grown in recent months to ~$92 million in supplied collateral, as of today. The bulk of supplied collateral is Maple’s own syrupUSDC of about $50.7 million.

For more on the broader DeFi lending landscape, see Blockworks Research’s Carlos Gonzalez Campo’s latest report.

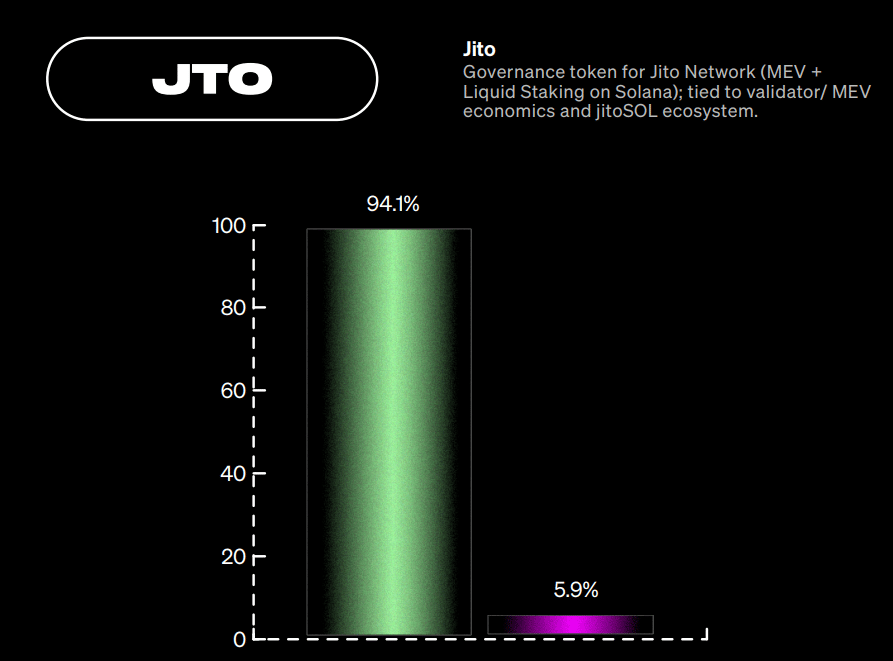

In a recent Lightspeed survey, we collected 50+ Solana investors’ sentiments on various tokens on Solana. JTO has the most positive sentiment, with about 94.1% of respondents signaling bullishness.

If you’d like to see sentiment for other tokens like KMNO, JUP and PUMP, you can access the full survey here.

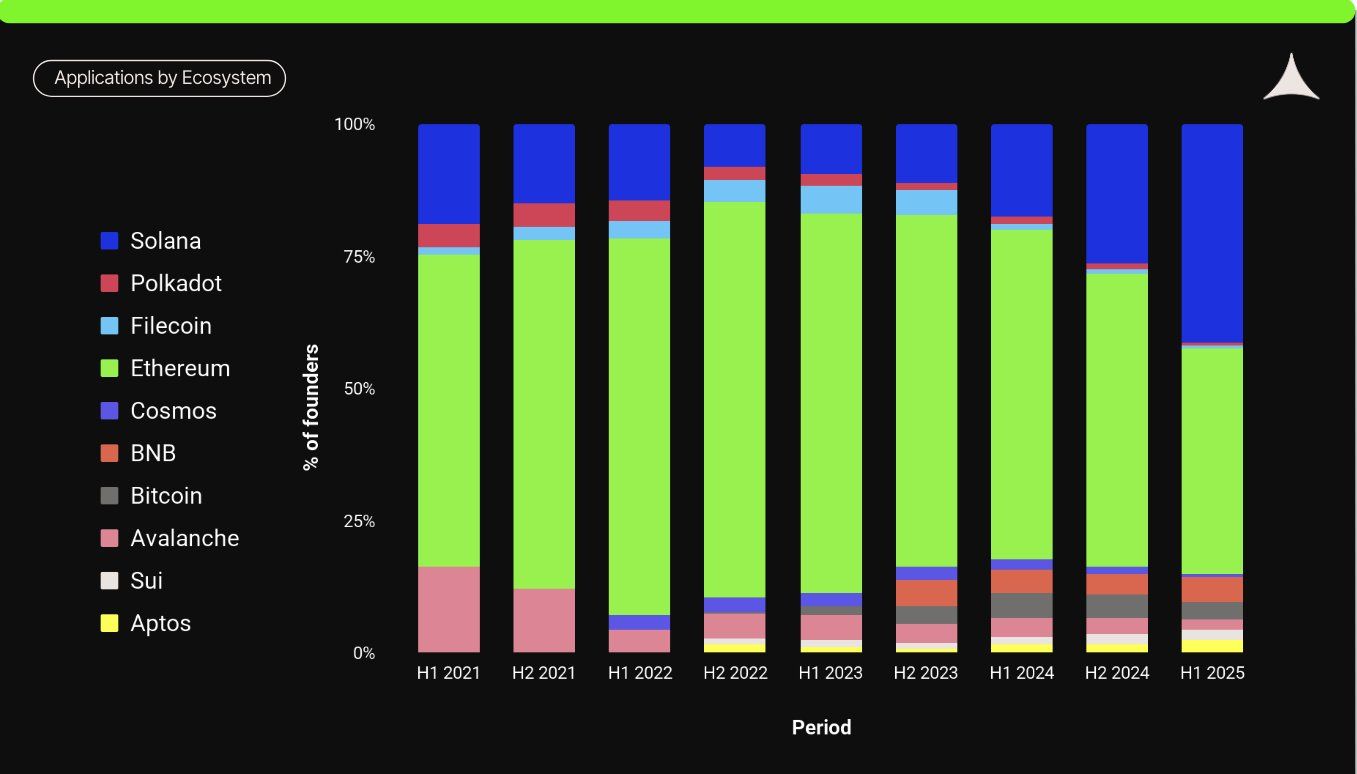

The proportion of new founders building on Solana continues to rise, based on data of applicants applying to Alliance’s accelerator. In the first half of 2025, the percentage of Solana founders exceeded 25% for the first time. The data notably excludes Hyperliquid though, so just keep that in mind.

Finally, Heaven, the latest memecoin launchpad to make waves on Solana this week, continues to hold up strong with 4,860 tokens launched yesterday.

Heaven brings a unique twist to the launchpad game with its tightly integrated launchpad and DEX protocol design, allowing the team to set customized parameters on fee collection and anti-MEV sniping mechanisms without the usual token bonding curve.

The team is pledging to send 100% of revenues to the buyback-and-burn of its native LIGHT token forever. I covered Heaven earlier this week too, which you can read all about here.

After being live for about a week, Heaven has already generated $3.2 million in revenue — all of which has gone toward a buyback-and-burn of 3.4% of the LIGHT token supply.

Brought to you by:

Katana is a DeFi chain built for real sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn boosted yield and KAT tokens: Deposit directly into vaults on the katana app and start earning on your ETH, BTC, USDC, and more.

Joining the Lightspeed podcast this week to talk about Jupiter’s latest Lend product are Kash Dhanda of Jupiter, and Samwak Jain, co-founder of Fluid. The podcast will be released early next week, but here are some takeaways from the conversation, paraphrased for readability:

What makes Jupiter Lend special?

Kash Dhanda: It’s simpler for lenders. Deposited assets will automatically find the highest source of yield across the protocol, so lenders no longer have to actively move their positions. For borrowers, they enjoy higher LTV ratios — a literal 100x improvement in terms of liquidation penalties. There’s also a “universal top-up” feature which lets anyone top up collateral from any wallet on behalf of somebody else.

What is the revenue-share agreement between Jupiter and Fluid?

Kash Dhanda: Jupiter Lend has a 50-50 revenue share agreement with the Fluid team.

If Jupiter wanted to do lending, why didn’t it just acquire or build out its own protocol?

Kash Dhanda: For us, it was largely a question of aligned incentives. As a purely financial matter, I don't think we could afford Fluid, and I don't think that Fluid has any interest in selling. They're extremely successful on many other chains and we just wanted to work with the absolute best. It’s a partnership based on 8-10 years’ worth of trust and history.

Is Jupiter Lend giving incentives?

Kash Dhanda: Right now we have more than $2 million in incentives lined up. There will be substantially more coming in over time as well.

It’s the summer of DATs and Solana has arrived at the party.

But when October rolls around, everyone will be looking to DAS: London to hear from these meta-defining voices on where things stand and where they’re headed.

Get your ticket today with promo code: LIGHT100 for £100 off

📅 October 13-15 | London