- Lightspeed

- Posts

- Investing in SOL at 4¢

Investing in SOL at 4¢

Oh to be back in 2018

hello

Today we’re bringing you a podcast roundup featuring Jack’s latest discussion with Viktok Fischer from RockawayX fund, an early Solana investor who participated in the 2018 round at just $0.04.

RockawayX’s 2025 Solana thesis

Jack Kubinec: What’s your thesis for investing in new L1s?

Viktor Fischer: We invested into Solana at $0.04, but we’re no longer investing into new L1s. The L1 game is over and it’s clear when I speak with developers – it's either Base or Solana. The VC market has completely changed. Before, you’d put $100K into an L1, you’d make a 1000x when it went to $100 billion. Now, even a successful investment reaches a billion dollars, or maybe $10 billion for a super successful hit like Plasma or Ethena. That’s not accounting for unlocks, which we haven’t seen for Ethena and Plasma. It’s become an ownership game.

Jack Kubinec: What’s the right narrative for Solana in 2025?

Viktor Fischer: It’s not store-of-value – it’s high growth and a yield-generating asset. Even bitcoin today is not a store-of-value, that’s not Michael Saylor’s pitch to Wall Street. The 60/40 portfolio no longer works due to high inflation. Our targets for SOL are $900 in the short-term, $2,000 in the medium-term and $6,000 in the long-term.

Jack Kubinec: mNAVs for DATs seem to be collapsing. What happens if this continues?

Viktor Fischer: Solana DATs need to communicate the value proposition of SOL yield well, then mNAVs will follow. If not, DATs will simply buy back their stock. Ultimately I think DATs will become ecosystem participants and ramp up businesses that are EBITDA positive and revenue-generating for their investors. They’ll be a channel of TradFi capital into Solana apps. DATs will be instrumental for Solana in 2026, the real impact will come next year. It’s too late in 2025 now because investors are waiting for quarterly reports in February 2026, which is when TradFi investors will realize the yield value prop and understand where mNAVs should be.

Full episode on YouTube, Spotify, Apple Podcasts and X.

DAS London: Get videos on demand

Jupiter DAO revamp:

Jupiter is making a series of significant changes to its DAO structure.

First, the DAO wants to trim governance bureaucracy by reducing the number of items to be voted on. The DAO will focus on a “narrower focus on broad tokenomics decisions and major treasury stewardship items,” Jupiter’s Kash Dhanda tweeted.

Second, JUP’s unstaking period will be cut from 30 days to seven.

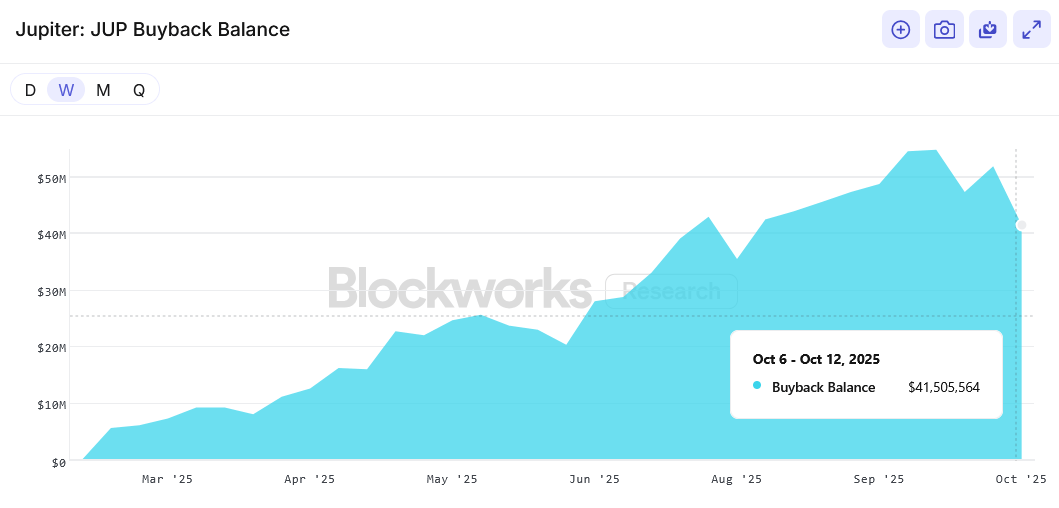

Third, Jupiter’s strategic reserve trust – the Litterbox Trust – will burn the already accumulated 121 million JUP tokens (worth about $42 million today), if approved by governance. Jupiter’s Litterbox currently receives 50% of all protocol revenues, which is then used to buy back JUP tokens on open markets.