- Lightspeed

- Posts

- 🙌 Meteora TGE is here

🙌 Meteora TGE is here

3 years in the making

Brought to you by:

hello

When I think “Meteora,” it’s not the Solana DEX that comes to mind, it’s the 2003 Linkin Park album that I listened to on my iPod Touch. Wow, time flies.

Meteora airdrops on Oct 23.

Meteora, one of Solana’s oldest DEX projects, is gearing up for its MET token generation event (TGE) tomorrow.

At first glance, two things stand out.

First, MET is an airdrop nearly three years in the making. Meteora began in February 2023 as “Mercurial Finance,” but was sunsetted and rebuilt as Meteora in the wake of the FTX/Alameda collapse. In an industry of compressed attention spans, few crypto projects sustain community patience for that long.

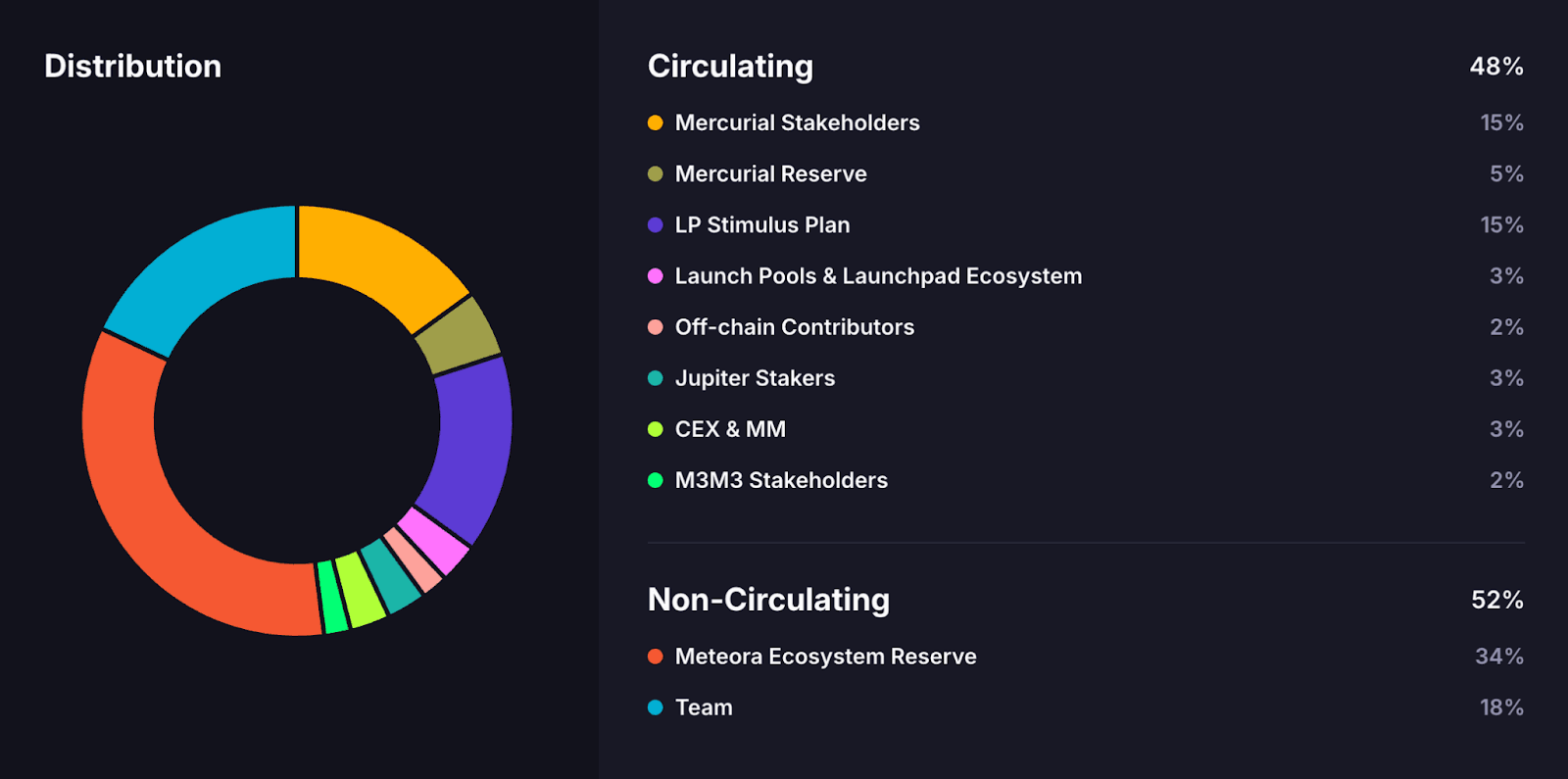

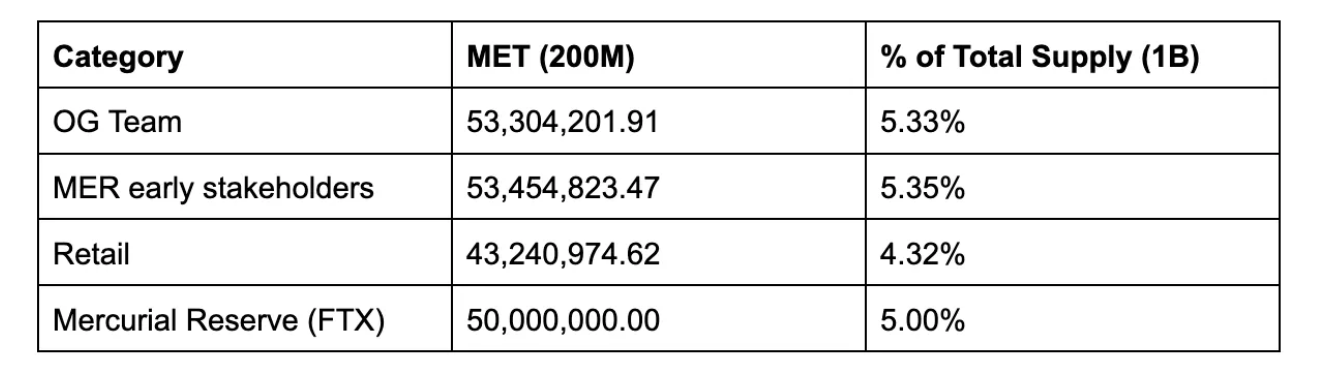

Second, MET’s tokenomics stand out. A disproportionately large float of 48% will be unlocked on TGE without any supply locks or cliffs — far above the industry norm of 10-25%.

45% of MET is earmarked for airdrops, with 20% to “Mercurial Stakeholders.” Within that bucket, 5.33% goes to the “OG Team,” a recent Meteora blog post details.

Source: Meteora

To mitigate potential sell pressure, Meteora is offering MET holders an incentive to stick around. MET holders can choose to claim their airdrop as an NFT representing an LP position in the MET/USDC launchpool, earning trading fees to encourage holding.

“We’re not looking at token utility at this point in time, the token will serve for (purposes of) alignment,” Meteora’s co-founder Zen said on Lightspeed. “We’ll use MET to coordinate pushes towards the future as well, so you can expect to see the token used in incentives and other coordination mechanisms.”

The Meteora business

At a high level, Meteora is in the decentralized exchange business and the token launchpad business.

Though commonly referred to as a “DEX”, Meteora does not host its own frontend swap UI. Meteora is, more strictly speaking, a liquidity infrastructural layer that other frontends such as Jupiter plug into.

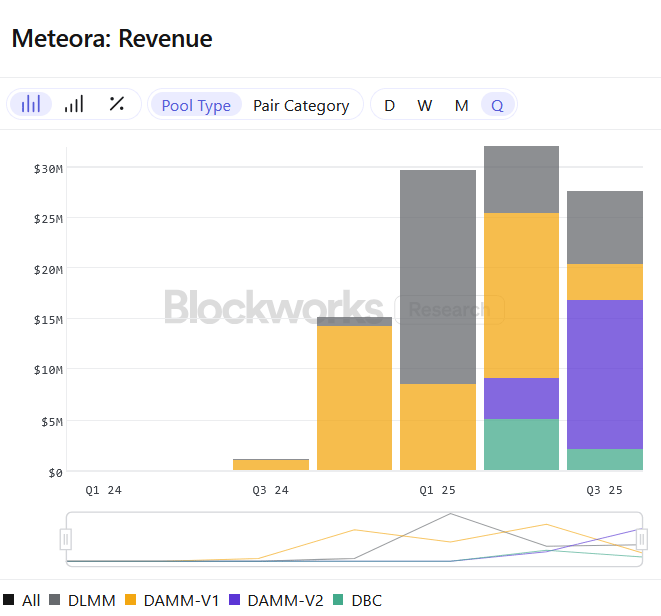

The liquidity layer earns a take of fees generated by LPs across the protocol’s core liquidity primitives – the DLMM (dynamic liquidity market maker) and DAMM (dynamic automated market maker) pools.

In the past year, Meteora’s DEX business has been threatened by the rise of “prop AMMs”, private DEXs with exclusive market-making advantages and tight spreads on liquid pairs like SOL-stablecoins (Orca and Raydium face the same pressures).

Meteora, Raydium and Orca’s combined DEX market share volumes have fallen from 77% to 36% in the past year, as Blockworks Research's Kunal Doshi pointed out.

Yet Meteora has generated fairly consistent quarterly revenues — $27.5 million in Q3 2025 — with the majority coming from memecoin trading activity on its DAMM-V2 pools, as seen in the below chart.

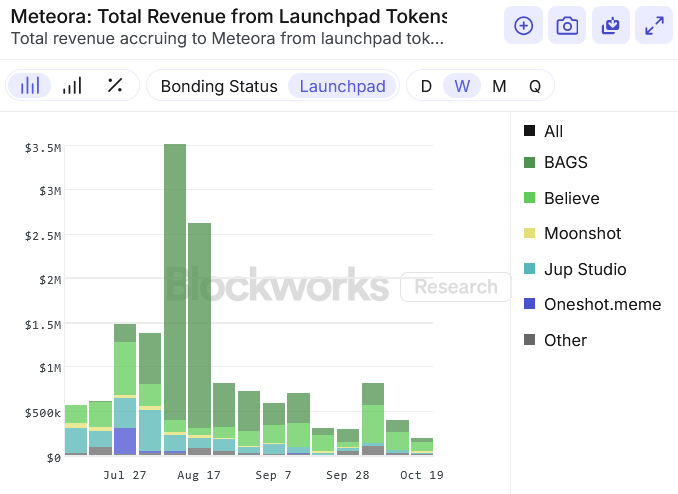

Meteora’s second line of business — launchpad tooling — was introduced with Moonshot in August 2024. That infrastructure is what underpins token launches for various memecoin launchpads today like Jup Studio, Believe and BAGS.

Launchpad activity on Meteora hit a weekly peak of $3.5 million in early August and has seen a decline to about $202K in the last week.

MET is currently trading at a premarket price of $1.03 on Hyperliquid, implying a $494 million market cap. For how that valuation compares against peers Orca and Raydium, check out Blockworks Research’s Carlos Gonzalez Campo’s analysis on 0xResearch.

Brought to you by:

Katana was built by answering a core question: What if a chain contributed revenue back into the ecosystem to drive growth and yield?

We direct revenue back to DeFi participants for consistently higher yields.

Katana is pioneering concepts like Productive TVL (the portion of assets are actually doing work), Chain Owned Liquidity (permanent liquidity owned by Katana to maintain stability), and VaultBridge (putting bridged assets to work generating extra yield for active participants).

DEX aggregator wars:

Solana’s DEX aggregator market is becoming increasingly competitive. Jupiter aggregator’s market share dipped to a recent low of 78.1% ($14.7 billion) last week, though it continues to lead overall activity.

Zooming in on the data, DFlow posted a record weekly volume of $2.3 billion while Titan processed $1.2 billion.