- Lightspeed

- Posts

- 👆 Momentum szn

👆 Momentum szn

Crypto’s summer slouch might finally be behind us

Howdy!

Congratulations on the long-awaited pump, Ethereum. Who knew? All the world computer needed was more Tom Lee CNBC hits.

Today, we’ve got a markets update, a looming TRUMP unlock, and Orca’s token launchpad:

Midweek markets: Chop’s over. Rally’s on. Let’s see if it holds.

After months of little ado about everything, the markets are finally seeing some of their old momentum.

As BTC surged above $122,000 on Monday, Solana was pulled along in the gravity tail of bitcoin's inflation-cooled rebound. SOL jumped 13% to reach $174.45 — its highest level in weeks — likely buoyed by the excitement around Pump.fun's recent, highly successful ICO.

On macro, this week's backdrop gave just enough breathing room for risk assets to stretch.

While the CPI came in hotter than expected at 2.7% year over year, the PPI cooled to 2.3%, below forecasts. In short, the split was just soft enough to soothe the market's anxiety over imminent Fed tightening, even if the July 30 FOMC meeting remains priced for a hold.

Meanwhile, President Donald Trump took to Truth Social to urge Republicans to support the GENIUS Act and a broader package of digital asset legislation, including stablecoin regulation and an outright ban on a Fed-issued CBDC.

While the House initially failed to pass the resolution, a motion to reconsider passed 215-211 the following day.

Back yonder in crypto land, the news spurred continued ETF inflows, thin but directional conviction from institutional buyers and a modest uptick in leverage.

Bitcoin's price hovers just below a cluster of liquidity between $119k and $121k, with market makers circling a $120k target before month's end.

Solana is showing signs of independent strength. Transaction activity holds steady at 100+ million per day, excluding validator votes, while staking remained healthy at a 66.43% participation rate and a net 7.17% yield.

Network revenue continues its uptick from a post-May lull, and app-level earnings showed similar resilience, with consistent fee generation from DEXs, token vending platforms and staking derivatives sustaining developer and validator income.

Predictably, the standout this week was Pump.fun. Despite challengers like letsbonk.fun drawing attention, Pump.fun saw nearly 30 million trades and over $1.7 billion in DEX volume, according to recent insights from Blockworks Research. 94% of this was concentrated in meme tokens. That said, Bonk is still winning on overall trading volume.

It also completed its blockbuster token generation event that targeted up to $1.3 billion across public and private allocations, with a $720 million private raise confirmed and a 25% discretionary buyback commitment.

With BTC defying gravity again and the Solana rabble growing louder, it's looking like those who patiently waited out the lull may finally find themselves back in action.

— Jeffrey Albus

P.S. Fill out our short audience survey and help us build a better Lightspeed. Thank you!

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

A fabled bullish unlock?

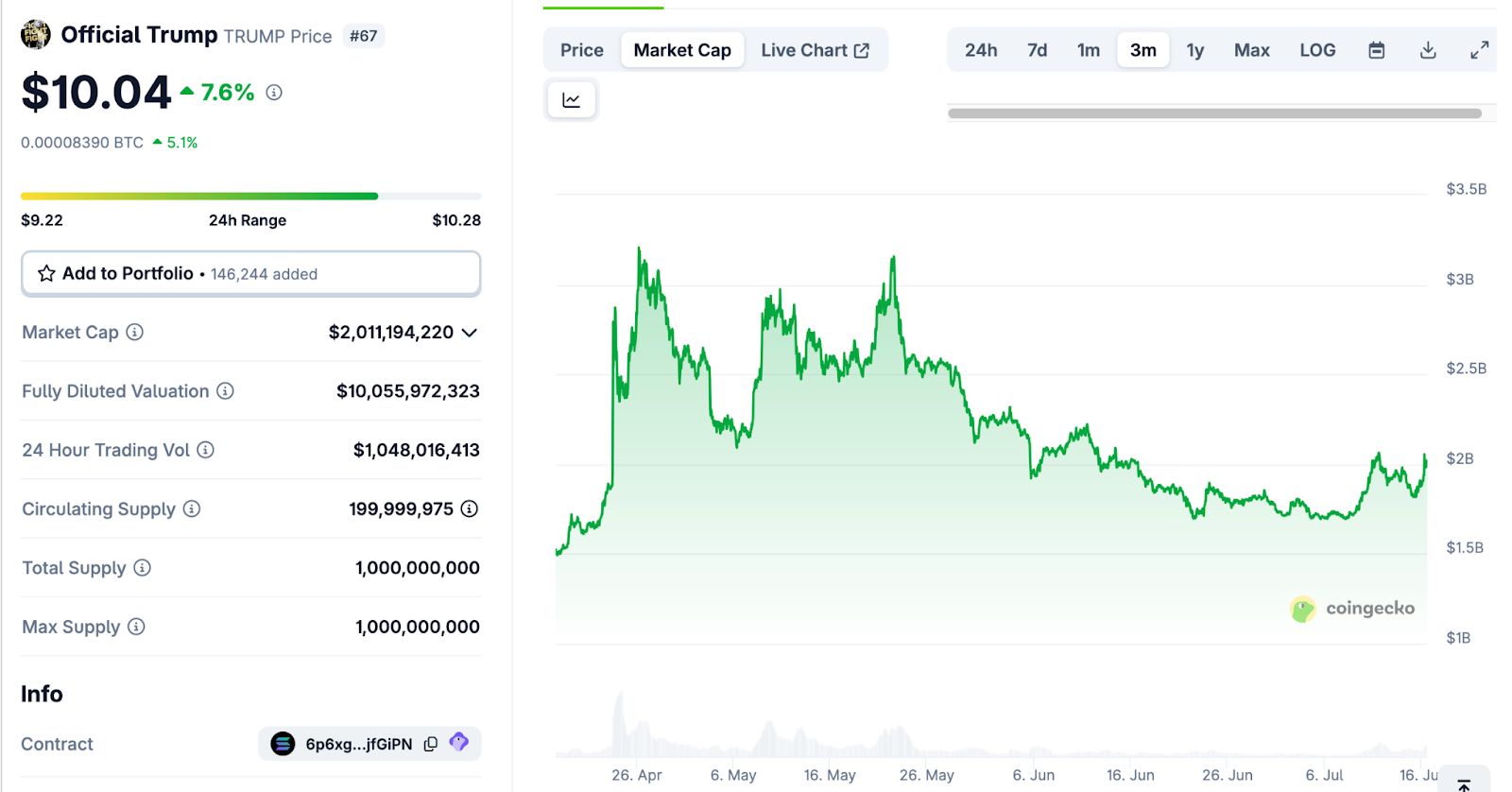

90 million TRUMP tokens — or 9% of the maximum supply — is set to be made available to a Trump-linked entity tomorrow, per data from Tokenomist.

Unlocks are generally thought to be bearish for token prices, although last time TRUMP faced an unlock, the president announced a dinner for his memecoin holders. I wonder if he’ll do it again this time around.

— Jack Kubinec

This morning, I broke the news on X that the Solana DEX Orca plans to release a token launchpad within the next few weeks.

My source at the DEX said the new product will be focused on prioritizing humans over bots — fixing what they see as a flaw in the launchpad space, where new tokens are often heavily purchased by bots. They kept their mechanism pretty close to the vest but said it won’t involve the already-tried ideas of taxes and buy timers.

I’m primarily interested in this news because it cements the concept that launchpads are increasingly becoming table stakes for Solana DEXs. To wit, Raydium, Ellipsis Labs, Jupiter and Meteora all offer either launchpads or launchpad infrastructure at this point.

“[The] DEX to launchpad pipeline is unavoidable,” Save founder Rooter said on X.

— Jack Kubinec

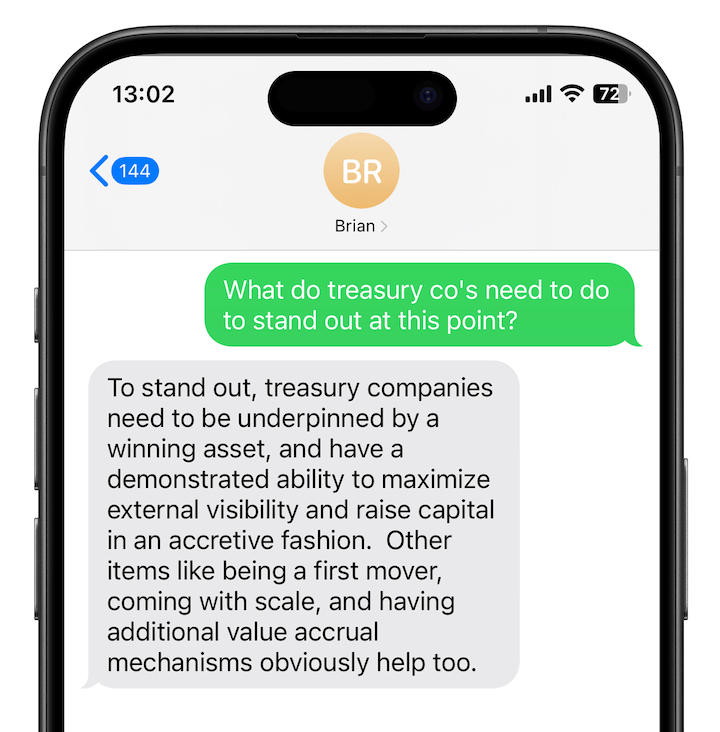

A message from Brian Rudick, chief strategy officer at Upexi:

Spread Solana cheer to make perks appear 🎉

Don’t keep us a secret. Tell your friends and bag some bonuses with the Lightspeed referral program.

📣 3 referrals: A personal shoutout in the Lightspeed newsletter

💬 10 referrals: Lightspeed host and newsletter writer Jack will put you in the One Good DM section of one edition