- Lightspeed

- Posts

- 🌠 Oracles at lightspeed

🌠 Oracles at lightspeed

Switchboard’s ‘Surge’

Howdy!

Today, Switchboard launches a new oracle, Sol Strategies gears up for its Nasdaq listing with a reverse stock-split, and Jito wants to give more money to JTO token holders.

Switchboard launches Solana’s fastest oracle yet

Switchboard’s new “Surge” oracle network goes live on mainnet today.

As Solana continues to reckon with competition from high-speed upstarts like Hyperliquid, one of the network's biggest price oracles is getting much faster. The oracle will be free to integrate, and is claimed by the Switchboard team to be the fastest on Solana yet.

How fast? Surge promises to deliver price feeds at a sub-100ms latency — a performance gain of about 8x faster and at roughly 1/100th the cost of existing oracle providers, according to the team’s press release.

That latency falls even lower to 8-25 ms should protocols choose to colocate with a Surge node on their backend, rivaling the oracle speeds of even CEXs.

The performance gain is achieved by key architectural changes under the hood.

Conventional “pull” oracles collect data, post it onchain and wait for network consensus before apps can read it — a pipeline that typically adds 2-10 seconds of delay.

Surge replaces that model with a direct WebSocket stream from the data source to applications, thereby bypassing the consensus step.

Prices are pushed by oracle nodes only when market prices change within a set range. This eliminates the wasteful slot-by-slot polling and gas spend that is standard fare on conventional “on-demand” oracles.

It’s an oracle targeted at high volume use cases in DeFi, in particular “latency-sensitive protocols/products like DeFi derivatives and oracle AMMs,” Switchboard co-founder Chris Hermida told Blockworks.

Surge is built on Switchboard’s open-source SAIL (switch forward attestation inference layer) framework, which uses trusted execution environment (TEE) hardware attestation to verify that each oracle node is running authorized Switchboard software code before it is allowed to onboard the network and serve data.

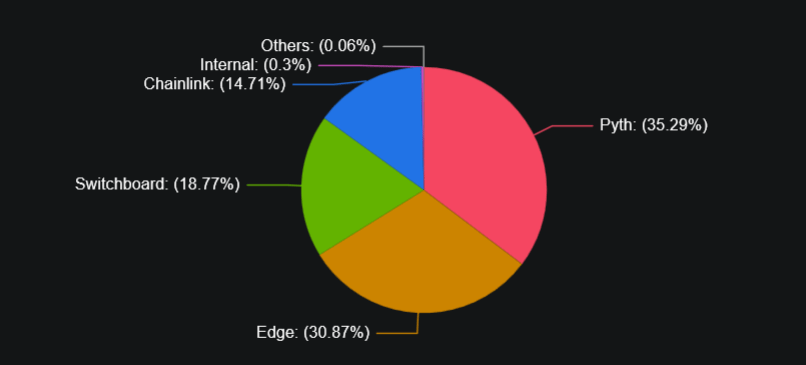

A snapshot of Solana’s oracle market today shows a fairly competitive market.

In terms of total value secured (TVS), Pyth leads the segment with $2.3b, followed by Edge ($2b) and Switchboard ($1.2b), DefiLlama data shows.

Note, though, that TVS measures the value of collateral that an oracle touches, not how often an oracle feed is consumed.

Blockworks Research’s Ryan Connor has argued that a better gauge for oracle market share is total transaction value (TTV) — the notional volume actually priced by the feed — because a high-frequency perps DEX can ping an oracle thousands of times more often than a passive money market securing the same dollar amount can.

If Surge gains adoption with high latency use cases, Switchboard’s share of activity could expand faster than its share of TVS.

For now, low-latency data on Solana is becoming a public utility — and Switchboard is first out of the gate.

— Donovan Choy

P.S. Fill out our short audience survey and help us build a better Lightspeed. Thank you!

Institutional DeFi has crossed the chasm from dream to reality and Ethena is leading the charge. $USDe has seen a $3.1B inflow over the last 3 weeks, outpacing all Bitcoin ETFs combined.

Guy Young joins the DAS: London lineup this Oct 13-15 to break down the value proposition of institutional DeFi.

Get your ticket today with promo code: LIGHT100 for £100 off

📅 October 13-15 | London

Bullish reverse stock split:

Some stock trackers are showing Sol Strategies up more than 700% on the day. But before you get excited, note that this is coming off the back of its reverse 1-for-8 stock split, a move being taken to meet the minimum bid price requirements for its upcoming Nasdaq listing under the STKE ticker.

To date, SOL Strategies has accumulated 428,777 SOL based on Blockworks Research data.

— Donovan Choy

JTO token holders, rejoice.

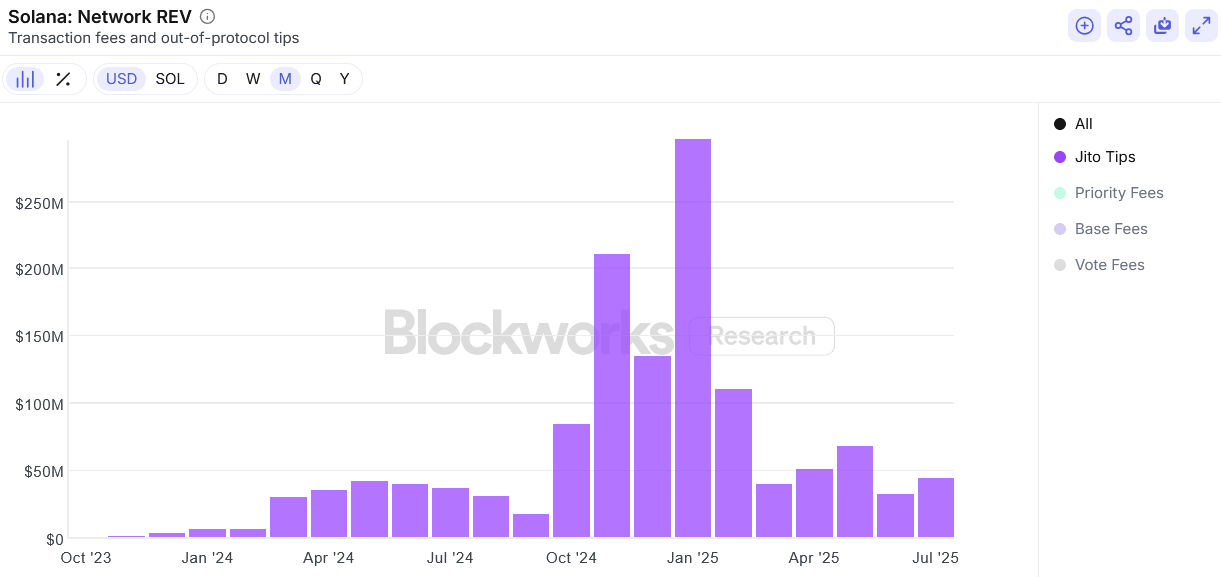

Authored by Jito CEO and co-founder Lucas Bruder himself, the latest JIP-24 proposal is proposing to route 100% of fees from its Block Engine and the newly launched BAM (Block Assembly Marketplace) to the DAO treasury.

Today, Jito takes a 6% fee from all MEV tips on its Block Engine, which is then split evenly between Jito Labs (3%) and Jito DAO (3%).

In the month of July, Jito tips amounted to ~$44.8m, Blockworks Research data shows.

Should JIP-24 come to pass, a 6% take-rate would see an estimated ~$2.68m flow to JTO token holders, or about $32.2m annualized.

— Donovan Choy

A message from Ian Unsworth, co-founder of Kairos Research:

Spread Solana cheer to make perks appear 🎉

Don’t keep us a secret. Tell your friends and bag some bonuses with the Lightspeed referral program.

📣 3 referrals: A personal shoutout in the Lightspeed newsletter

💬 10 referrals: Lightspeed host and newsletter writer Jack will put you in the One Good DM section of one edition