- Lightspeed

- Posts

- 🪫 The end of zero marginal cost tech

🪫 The end of zero marginal cost tech

Software investing is hard

hello

Here’s a fun fact: Had FTX held its ~8% Anthropic stake through yesterday’s $183 billion round, it’d be worth about $12.6 billion today — about $11 billion more than the estate realized in 2024. Shame!

Software investing is no longer zero marginal cost

Would you rather invest in the business model of a cinema or Netflix?

A theater needs real estate, seats, projectors and staff. When it’s full, you top out at ~200 paying customers per show.

Netflix beams the same video to its first customer and its millionth customer with basically the same operational cost.

That zero marginal cost is the intuition behind why investing in tech is attractive. Once you’ve built the product, each additional user generates a high gross margin, which produces sky-high multiples.

Now, that mental model of zero marginal cost + uncapped demand is being stress-tested.

In AI for instance, serving the next user is not free. Your “software” rides on someone else’s model (OpenAI, Anthropic, Google, etc.). Each user interaction burns inference tokens, which in turn costs real compute, power and data center capacity.

Even as unit prices per AI token trend down, token consumption per task rises, so the bill goes up.

For a few years, Anthropic aggressively courted developers with enterprise-friendly pricing mechanics (e.g. prompt caching, batch discounts).

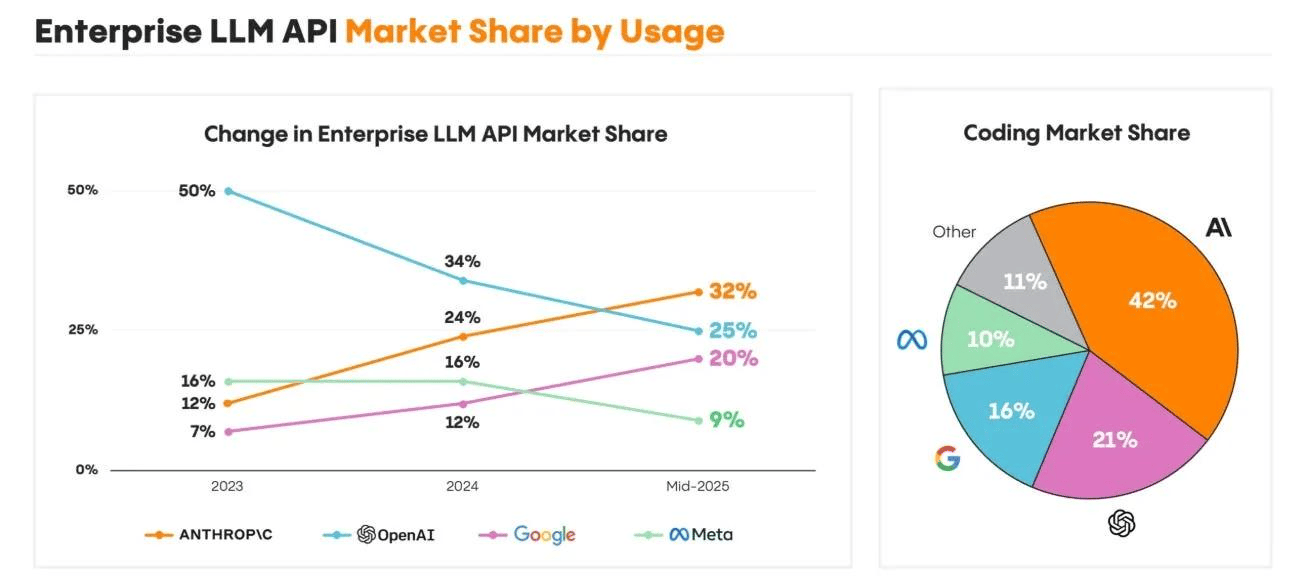

That strategy worked! In enterprise usage share, Anthropic has overtaken OpenAI — 32% vs. OpenAI’s 25% by usage.

OpenAI lately responded by slashing prices. GPT-5’s API recently launched with $1.25/M input and $10/M output tokens, explicitly leaning into coding and agent use cases.

That’s dramatically cheaper than Anthropic’s Claude Opus’ prices at $75/M output tokens ($15/M input)!

With that, AI wrapper companies like Lovable, Cursor, Bolt and more have quickly moved to integrate GPT-5.

"For the first time in SaaS history, the marginal cost of adding on a user is not close to zero," said Amanda Huang of Bain Capital Ventures, per Pitchbook.

Crypto often looks like software economics. Once a chain is live, serving the marginal user is close to free.

That is theoretically true, but not necessarily so in practice.

Because while validators (proof-of-stake) incur zero marginal costs to produce the next block, when demand spikes, users want to pay to jump the queue.

That’s why MEV (maximal extractable value) persists. Being first in line is valuable, and blockchain networks explicitly price that preference.

On Ethereum, EIP-1559 formalized congestion pricing via a base fee plus optional tip. On Solana, “priority fees” exist precisely because blockspace is scarce at the margin — even if the average transaction is cheap.

Crypto investors like Multicoin’s Kyle Samani have explicitly argued in favor of valuing blockchains solely on MEV.

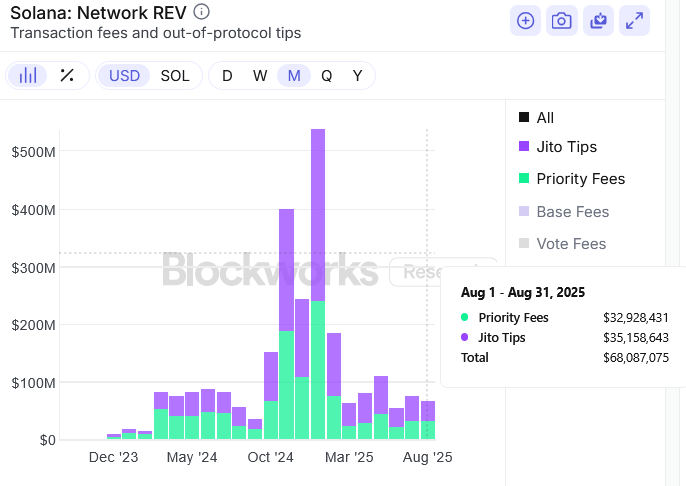

In the month of August, Solana did $68 million in MEV.

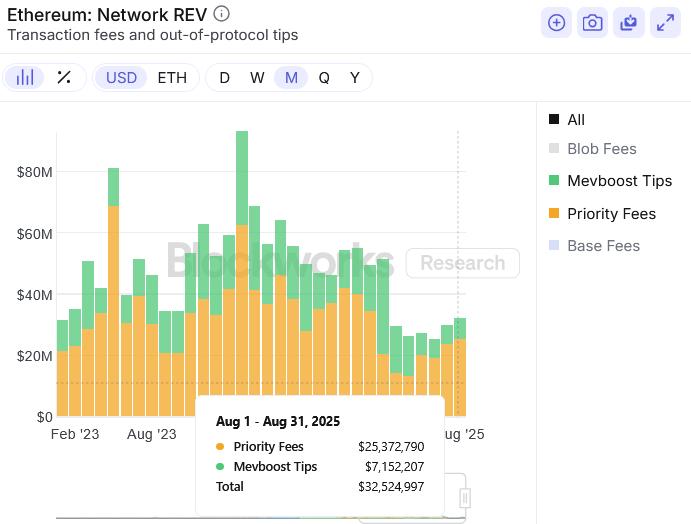

Across the same month, Ethereum saw $32.5 million in MEV.

Classic SaaS multiples assume high, stable gross margins and flat marginal costs.

But in both AI and crypto, that logic can be sometimes inverted. In crypto, even with low nominal fees, blockspace scarcity created pricing power (priority fees, MEV).

And in AI, “wrapper” applications that pass through model costs behave more like usage-metered utilities. Margins compress unless teams negotiate discounted batched rates.

What does this mean for the players involved? I guess you could just raise more venture money to subsidize usage.

Anthropic, for example, yesterday raised $13 billion at a whopping $183 billion valuation to compete with OpenAI.

L1/L2 chains have also raised hundreds of millions historically, but you don’t need that much money to build a chain. Similarly to Anthropic, the money is merely a competitive weapon to fund subsidies, incentives and liquidity programs.

In both arenas, the bulk of venture dollars flow to subsidies aimed at entrenching network effects.

In the near term, consumers benefit from lower prices and better service. Enjoy it while it lasts.

If SQL and protocol deep-dives are your playground, this is it.

Join Blockworks as a Data Analyst and help us set the standard for protocol analytics. Build dashboards, shape frameworks, and help the industry see past the noise.

Apply now or pass it along to the Dune wizard in your group chat.

Alpenglow passes:

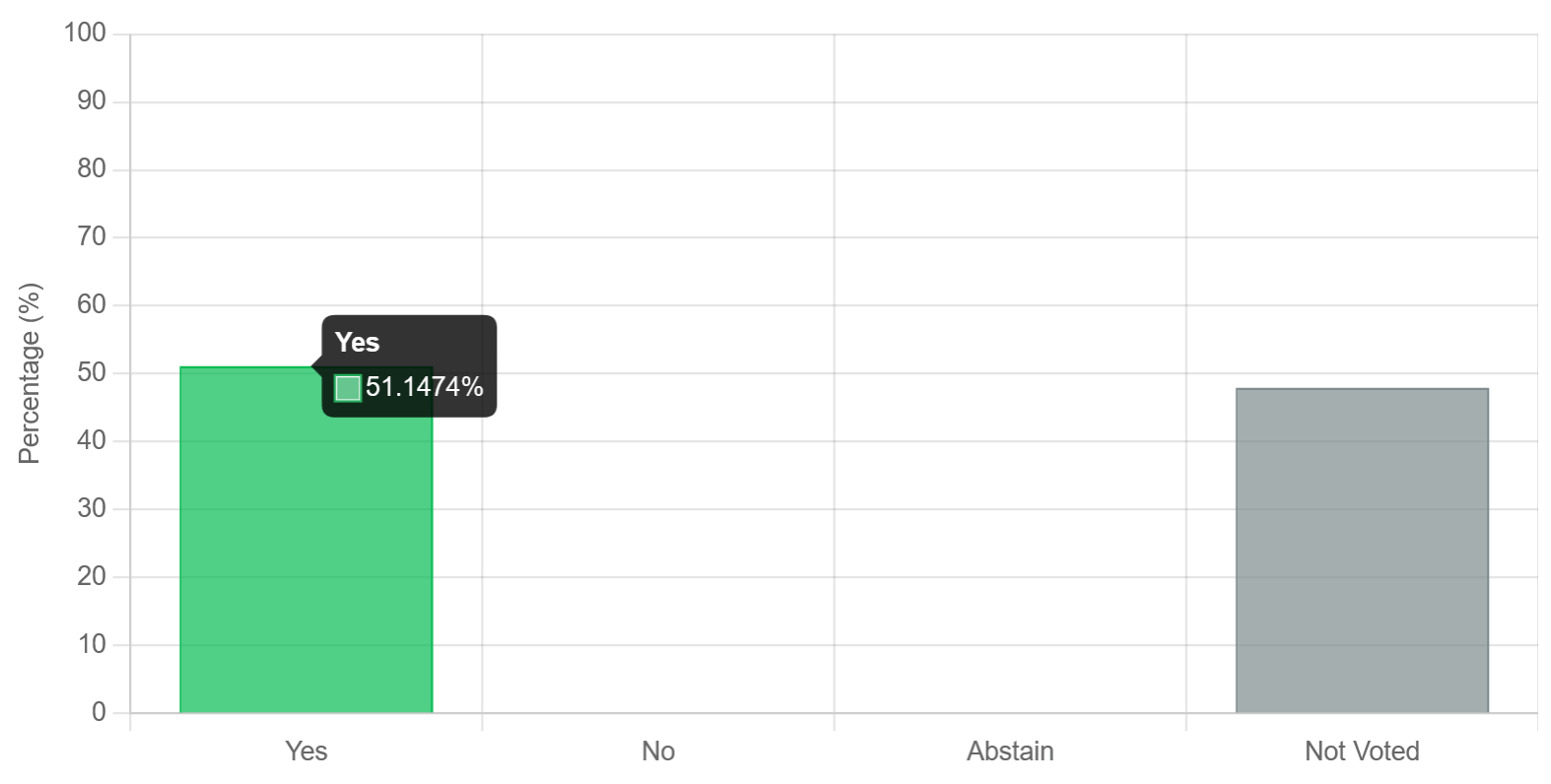

The Alpenglow election is over and SIMD-0326 passed without a hitch. 51.1% of all validators, or 98.9% of all participating stake voted “Yes,” well past the necessary quorum of 66.6%.

Pokemon cards onchain:

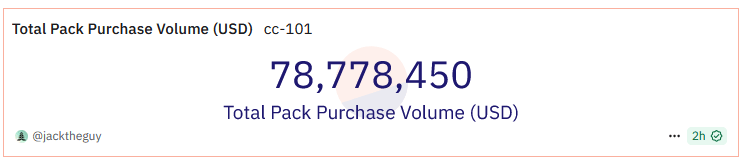

Collector Crypt is the latest viral gambling app to make waves on Solana.

Users deposit USDC with a wallet, then pay $50-$250 for a chance to pull a rare tokenized Pokemon card. To date, at least $78.7 million has been spent on these Gacha-like games. These cards are part of Collector Crypt’s internally curated inventory of PSA-graded Pokemon cards, so keep in mind that you aren’t actually opening sealed boosters.

You can then trade the card on a secondary marketplace like Magic Eden, burn the NFT to redeem the physical card from an Oregon vault, or immediately sell back the card to Collector Crypt at 85-90% of its paid Gacha value — presumably to continue hunting for a rare card.

Collector Crypt has made nearly $1 million in revenue over the past week. Its CARDS token has pumped 230% to a $56 million market cap in the last 24 hours.