- Lightspeed

- Posts

- 🐋 Whale watching

🐋 Whale watching

A whale bought PUMP from 500 addresses

Howdy!

Welcome to the 300th edition of Lightspeed. It’s been a fun ride watching this thing grow — here’s to the next 300!

Today, we’ve got pump.fun’s token debut and a hiring scoop:

500 wallets, 1 whale

On July 12, the Pump.fun ICO sold out in 12 minutes, raising over $500 million onchain and an additional $100 million via centralized exchange partners. The ICO attracted over 10,000 wallets with a median buy-in of $537, according to Blockworks Research data.

Quite a big win for Pump, especially considering that we are long past the days of sell-out ICOs being the norm.

But underneath the ICO’s record-breaking demand, some interesting anomalies emerged.

One wallet (88888FAoqY6JdSvz7fk1FPd6qjPTcCMGcS64GbwonLoE) funded 500 different addresses, each with $400 in USDC and 0.05 SOL for gas, according to data compiled by Blockworks researchers.

These wallets all participated in the ICO, purchasing $200,000 in PUMP tokens before fees. One wallet appears to have utilized centralized exchanges to create the illusion of being many wallets. It’s an impressive feat given that KYC checks were required to purchase PUMP.

Onchain data shows the wallet’s activity in sequence: Withdraw stablecoins from Bybit and Binance, distribute them evenly to 500 wallets, send a bit of SOL to cover gas fees and have each wallet contribute exactly $400 to the ICO.

Researcher Sharples notes that these wallets show up under the “unknown address” category in Blockworks Research’s funding source chart, skewing the optics of distribution.

Blockworks’ Dan Smith tracked the wallet’s history and found that the actor previously used the same network of addresses to spoof holder counts in low-float memecoins like ARTIC and WUKONG.

Nine months ago, these wallets were dusted with 0.000000001 tokens to inflate “unique holder” metrics. ARTIC later rugged. It’s worth noting that the use of older wallets may help bypass anti-Sybil heuristics that flag recently funded/created addresses.

Some have suggested that the orchestrator may have been speculating on future airdrops or bonuses for small buyers. By splitting a $200k allocation into hundreds of sub-$500 entries, the whale could appear to be 500 unique participants — each potentially eligible for future rewards from Pump.fun or third-party protocols.

Of course, none of this is to suggest that Pump.fun had any involvement in the behavior of this currently anonymous whale. Once tokens are live, it’s pretty impossible to control how wallets participate.

What is clear, however, is that without strong Sybil resistance, sophisticated actors can game even well-structured launches using fragmented wallets and coordinate funding strategies to dominate allocation, spoof demand and manipulate downstream incentives.

— Jeffrey Albus

P.S. Fill out our short audience survey and help us build a better Lightspeed. Thank you!

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

The most hated chart in some time debuted today:

PUMP pumped shortly after being made available for trading, briefly crossing a $6 billion FDV, which was a 50% premium on its $4 billion ICO price.

The token fell back to Earth in the mid-afternoon, though ICO buyers are still in the black: PUMP’s FDV was $5.3 billion at press time.

— Jack Kubinec

Earlier today, I scooped that BlockFi co-founder Flori Gilroy has become senior vice president of SoFi’s crypto unit.

BlockFi was one of the high-profile crypto bankruptcies from 2022, and after being acquired by FTX, it also became relevant in the industry’s biggest-ever fraud case (there is no allegation of fraud on the part of BlockFi, to be clear).

But all that bad juju seems to be gone now: Gilroy landed an executive role at a major fintech company, and co-founder Zac Prince was hired as managing director at Galaxy Digital.

SoFi — which paused crypto trading in 2023 before reviving the business vertical this year — now at least yields some talent from its 2018 seed investment in BlockFi. The tech-friendly online bank gains a crypto head with deep experience in the industry in Gilroy.

SoFi stablecoin incoming?

— Jack Kubinec

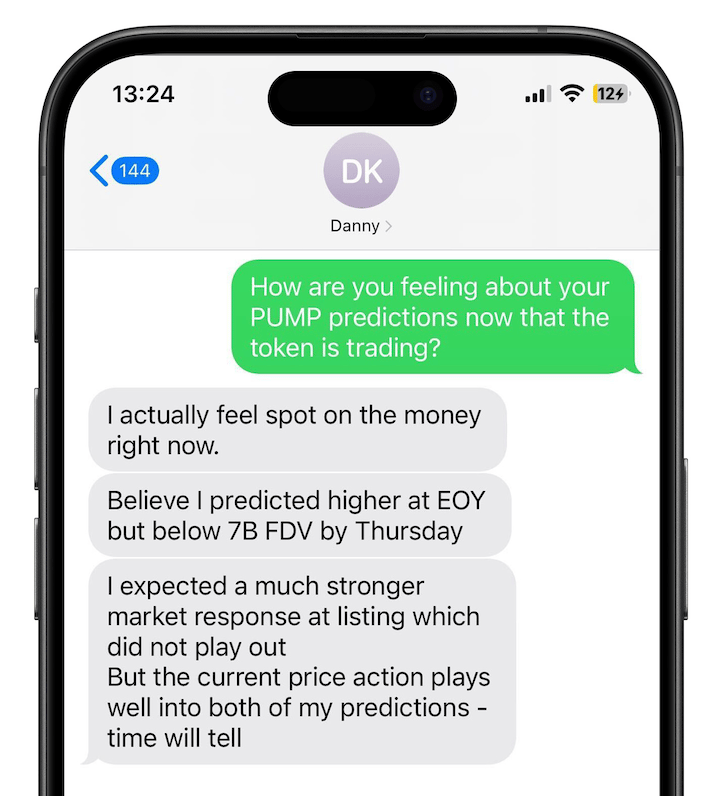

A message from Danny K, host of 0xResearch:

Spread Solana cheer to make perks appear 🎉

Don’t keep us a secret. Tell your friends and bag some bonuses with the Lightspeed referral program.

📣 3 referrals: A personal shoutout in the Lightspeed newsletter

💬 10 referrals: Lightspeed host and newsletter writer Jack will put you in the One Good DM section of one edition